Our Year in Review

2025 was a year of momentum for PMI Potomac — steady, intentional, and grounded in the belief that property management can be both a business and a force for good. We’ve always said that people should know us, not just the logo on our shirts. This year, that philosophy guided every decision we made.

We grew our portfolio, strengthened our vendor network, supported our community, and continued building a company that reflects our values: professionalism with personality, transparency, trust, and a little fun along the way. We’re proud of the progress we made, grateful to the people who helped us get here, and excited for what’s ahead.

Thank you for being part of our story — whether you’re an owner, a vendor, a referral partner, or a neighbor. We couldn’t do this without you.

— Matt & Susan

Portfolio & Operational Strength

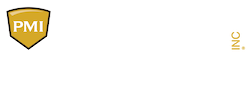

PMI Potomac closed 2025 with 110 doors under management, spanning single-family and multifamily homes. This stable portfolio allowed us to refine operations and deliver consistent value to owners and tenants.

Operational efficiency remains a core strength:

- ~36 doors per employee with a three-person team

- Turnover efficiency and lowering days on market were focus areas throughout the year

This efficiency reflects strong processes, good communication, a fair pricing strategy, constant vendor coordination, and marketing discipline.

KPI Dashboard

Our 2025 operational metrics reflect a business that is stable, efficient, and built for long-term sustainability. Despite strong rental market headwinds in the DMV, we maintained strong comparative leasing performance, improved tenant retention, and continued to refine our processes to deliver consistent value to owners and tenants. These KPIs represent the foundation of our growth and the systems that support our service quality.

Financial Performance

Our financial performance in 2025 reflects a business that is maturing, becoming more efficient, and increasingly capable of producing strong results during peak leasing periods. While the year included natural fluctuations tied to seasonality and marketing cycles, the overall trajectory shows a company strengthening its operational and financial foundation.

Revenue & Profitability Trends

Revenue and profitability followed a clear seasonal rhythm. Early-year performance was steady, mid-year brought volatility, and late-year produced some of our strongest months.

High-performance periods were driven by:

Strong leasing activity

High contract acquisition

Controlled marketing spend

Efficient operations

Months with heavier marketing investment or slower turnover naturally produced lower revenue — a normal seasonal pattern for a growing property management company.

Per-Unit Efficiency

Per-unit revenue and profit improved significantly during months with strong leasing volume. When new leases were high and marketing spend was efficient, per-unit profitability rose sharply. This demonstrates that our systems, vendor network, and pricing strategy scale effectively as activity increases.

Marketing Efficiency& Acquisition Strength

One of the clearest lessons from 2025 is that our referral network is a major competitive advantage. Many of our strongest acquisition months occurred when marketing spend was low, showing that:

Relationships drive growth

Community involvement pays off

Vendor and partner trust translate into new business

This reduces our cost of acquisition and strengthens long-term sustainability.

Leasing Performance

Leasing remained a core strength throughout the year. Key indicators:

Days on Market ranged from the low 20s to the high 80s depending on season/market

Lead volume remained strong even when DOM increased

Views per listing rose significantly in Q4

New leases per month consistently stayed in the 2–10 range

Demand for our listings remained high, and our leasing processes continued to perform even during seasonal slowdowns.

Tenant Retention & Turnover Costs

Two of the most encouraging trends:

Tenant retention increased, averaging roughly 531 days

Owner turnover costs decreased late-year

Longer tenancies and lower turnover costs directly improve owner ROI and reflect the quality of our tenant screening, maintenance responsiveness, and communication.

The Bottom Line

2025 demonstrated that PMI Potomac is a resilient, relationship-driven, and operationally strong company. Our financial performance improved as the year progressed, our leasing engine delivered consistently strong results, and our referral network continued to be a major driver of growth. These trends position us well for the next phase of expansion and for achieving our long-term goal of building a self-sustaining, scalable property management company.

Community Impact

Community isn’t a side project for us — it’s one of the pillars of a self-sustaining property management business. Strong companies don’t grow in isolation. They grow because they invest in people, neighborhoods, and the systems that support them.

Community impact is one of the pillars of aself-sustaining property management business. In 2025, we exceeded our fundraising goal for Manna Food Center, supporting families facing food insecurity in Montgomery County. We also contributed to SEEC and supported causes championed by our networking partners, reinforcing our belief that strong businesses uplift the communities they serve.

These aren’t slogans — they’re daily practices.

Our Operating Philosophy

Our operating philosophy is built on eight pillars that guide every decision we make — from how we serve owners and tenants to how we grow the business. These pillars reflect our commitment to operational excellence, financial discipline, community benefit, strong partnerships, and personal sustainability. They are the framework behind our culture and the roadmap for our long-term goals of building a self-sustaining property management company infused with our ethos.

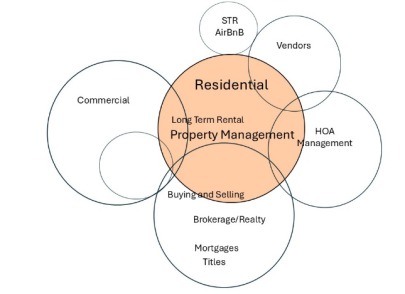

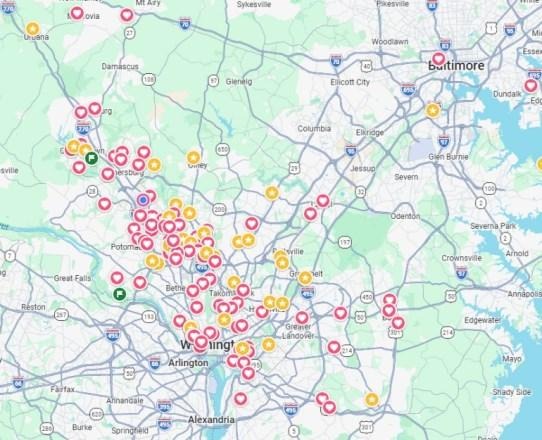

Where We Work & What We Do

PMI Potomac operates at the intersection of Residential Property Management, Commercial Property Management, HOA Management, and Real Estate Services. Our core focus is long-term rental management, supported by brokerage partnerships and a strong vendor network.

Short-term rentals (STR/Airbnb) sit outside our service model — intentionally. We focus on long-term rentals because they create stability for owners, predictability for tenants, and healthier neighborhoods.

PMI Potomac operates at the intersection of residential management, commercial oversight, HOA support, and real estate services. Our intentional focus on long-term rentals creates stability for owners, predictability for tenants, and healthier neighborhoods. Short-term rentals sit outside our service model by design — allowing us to stay focused on sustainable, long-term relationship-driven property management.

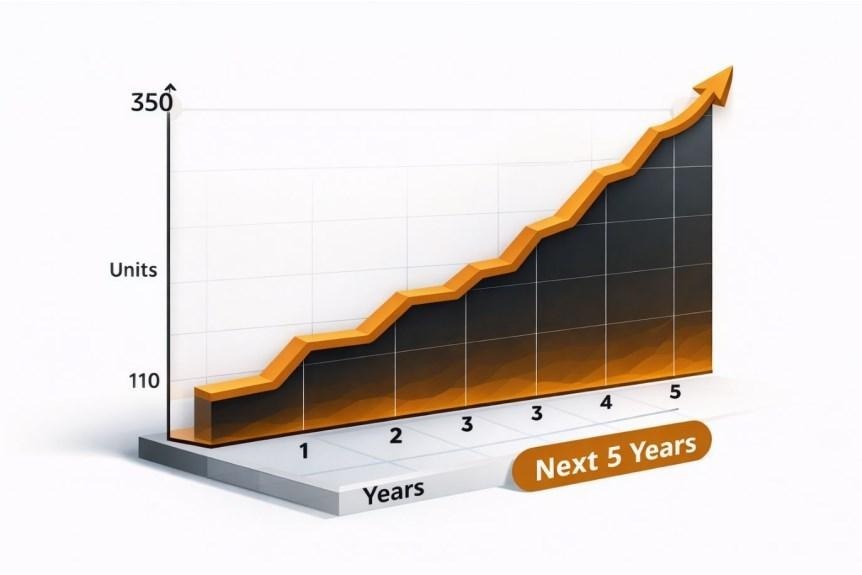

Looking Ahead: 2026–2030 Vision

Our long-term vision is clear: reach 350+ doors and build a company that can stand on its own — one that has value beyond the sum of its contracts.

Growth Strategy

Maintain and strengthen vendor and referral networks

Acquire small local property management companies

Purchase books of business from retiring or relocating managers

Improve operational efficiency

Maintain community involvement as a core differentiator

We’re building a thriving company to care for our client’s assets and to build our community — not just a list of accounts.